Secure Transactions Made Easy: Understanding Escrow Services

18-Mar-2025

Processingescrow

The Role of Escrow Services in Facilitating Secure Transactions

In today's digital economy, trust serves as the bedrock for successful commercial exchanges. Whether engaging in the acquisition of high-value assets, procuring the services of a freelance professional, or making strategic investments, ensuring the mutual fulfillment of obligations by all parties involved can present considerable challenges. Escrow services address this need by providing a secure and impartial mechanism for conducting transactions, thereby mitigating the risks of fraud or non-payment.

Definition of an Escrow Service

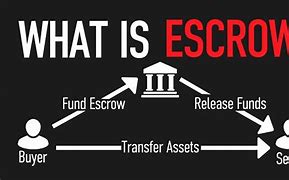

An escrow service constitutes a fiduciary arrangement wherein a neutral third party assumes the responsibility of holding funds on behalf of two transacting parties until a predetermined set of conditions has been satisfied. Upon the fulfillment of these agreed-upon terms by both parties, the escrow service releases the held funds, thereby ensuring an equitable and secure exchange.

Operational Framework of an Escrow Service

- Agreement Formalization: The purchaser and vendor mutually agree upon the specific terms and conditions governing the transaction.

- Fund Deposition: The purchaser deposits the agreed-upon funds into the designated escrow account.

- Provision of Goods/Services: The vendor delivers the stipulated product or service to the purchaser.

- Verification and Approval: The purchaser verifies that the received product or service conforms to the agreed-upon terms and conditions.

- Fund Disbursement: The escrow service transfers the held payment to the vendor.

Rationale for Utilizing an Escrow Service

- Fraud Deterrence: Provides a protective measure for both purchasers and vendors against fraudulent activities.

- Dispute Adjudication: Serves as an impartial mediator in the event of any transactional conflicts.

- Transaction Security: Eliminates the potential for chargebacks and payment irregularities.

- High-Value Transaction Suitability: Particularly advantageous for transactions involving real estate, freelance engagements, and online marketplaces.

Common Applications of Escrow Services

- Real Estate Transactions: Safeguards the interests of both purchasers and vendors in property transactions.

- Freelance and Contractual Engagements: Ensures fair and timely compensation for services rendered.

- Online Marketplace Transactions: Secures high-value purchases, including electronics, vehicles, and collectibles.

- Domain and Website Sales: Protects both purchasers and vendors in the transfer of digital assets.

Selecting an Appropriate Escrow Service Provider

When choosing an escrow service provider, it is prudent to consider factors such as service fees, implemented security protocols, dispute resolution procedures, and the quality of customer support. Prioritize escrow providers that are duly licensed and regulated, and which offer transparent and clearly defined terms of service.

Conclusion: Enhancing Transactional Confidence Through Escrow Services

Escrow services provide a valuable layer of assurance in financial transactions, fostering fairness, security, and reliability for all participating parties. Whether you are a purchaser, a vendor, or a service provider, the implementation of an escrow system can significantly enhance confidence in your business dealings.

Seeking a secure escrow solution? Consider integrating this valuable tool into your transactional processes today.